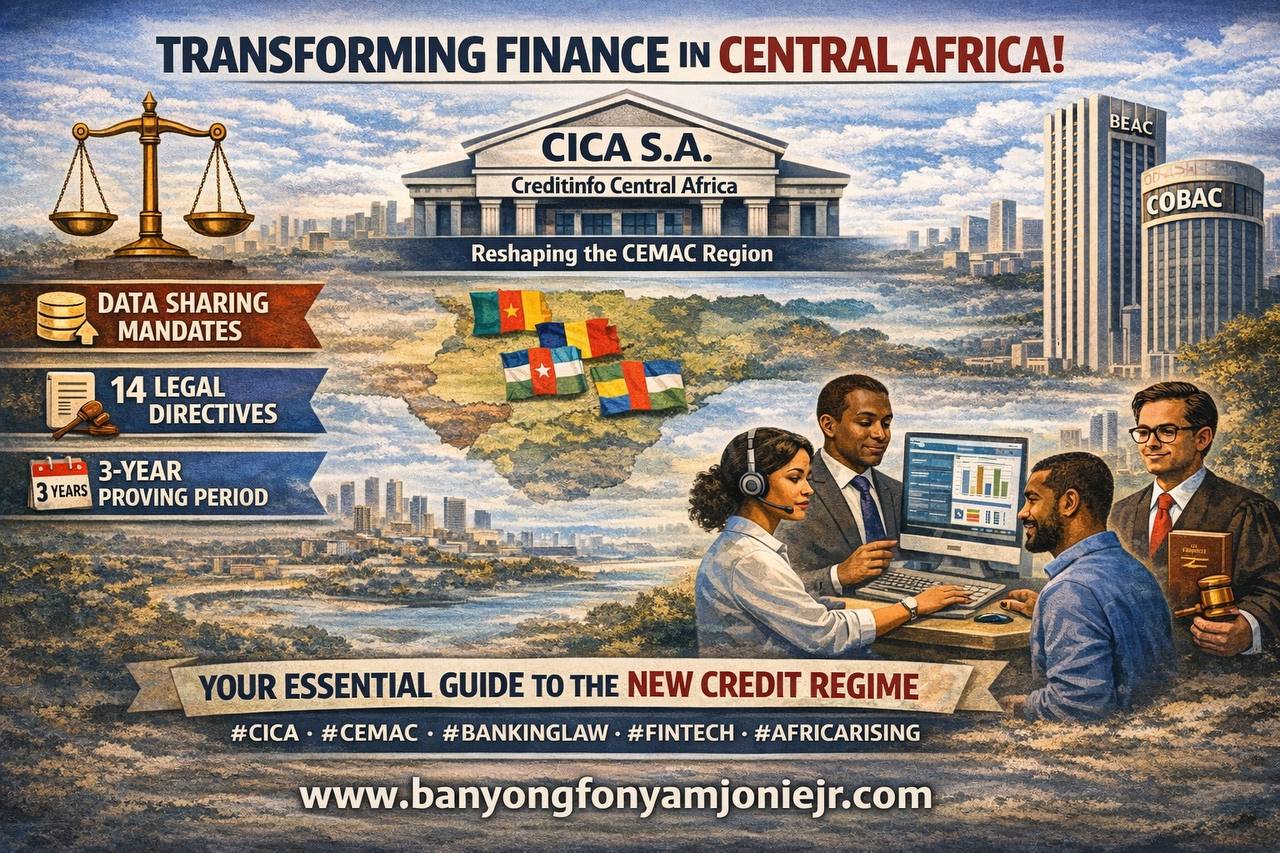

Decoding CICA: How Africa’s Newest Credit Bureau Will Transform Banking in Cameroon & CEMAC

I. INTRODUCTION & EXECUTIVE SUMMARY

The official launch of Creditinfo Central Africa (CICA) S.A. on January 20, 2026, in Douala represents a watershed moment in CEMAC’s financial sector development. As the region’s first approved Credit Information Bureau (BIC), CICA operates under a sophisticated regulatory framework established by the Bank of Central African States (BEAC) and the Banking Commission of Central Africa (COBAC). This guide provides a comprehensive analysis of the legal environment governing BICs, with particular reference to CICA’s operational context.

Key Takeaway:The system is built on mandatory participation by financial institutions, strict consumer protection protocols, and performance obligations for BICs, with CICA serving as the pioneer entity under a 3-year proving period.

II. FOUNDATIONAL LEGAL FRAMEWORK

A. Core Regulation

- Regulation No. 03/18/CEMAC/UMAC/CM(December 21, 2018): The cornerstone text defining BICs as entities authorized to professionally and exclusively collect, compile, store, process, and disseminate credit information from public sources or data providers.

B. Implementing Instruments (14 Key Instructions)

The regulatory framework is operationalized through 14 detailed instructions issued in 2020:

- Instruction No. 001/2020 – Code of Conduct for BICs

- Instruction No. 002/2020 – Minimum Capital, Application Procedures for BIC Approval

- Instruction No. 003/2020 – Authorization Procedures for Subsidiaries of De-authorised BICs

- Instruction No. 004/2020 – Conditions for Opening Subsidiaries/Branches

- Instruction No. 005/2020 – Authorized Related Activities

- Instruction No. 006/2020 – Data Protection Unit Requirements

- Instruction No. 007/2020 – BIC Control Procedures

- Instruction No. 008/2020 – Database Transfer to BEAC upon De-authorization

- Instruction No. 009/2020 – Procedures for Prior Authorizations

- Instruction No. 010/2020 – Customer Consent Procedures

- Instruction No. 011/2020 – Fee Schedule Approval & Publication

- Instruction No. 012/2020 – Customer Complaint Handling

- Instruction No. 013/2020 – Financial Penalties Applicable to BICs

- Instruction No. 014/2020 – Nature & Modalities of Credit Information Transmission

III. KEY LEGAL PRINCIPLES & OBLIGATIONS

A. For Credit Information Bureaus (CICA Specifically) - Approval Requirement: CICA operates under BEAC Governor Decision No. 142/GR/2025 (November 21, 2025).

- Performance Conditions:

– Must achieve 60% coverage of credit/microfinance institutions across CEMAC within 3 years

– Must expand to all CEMAC countries

– Must contribute to financial education, particularly on data security - Operational Mandates:Must comply with all 14 implementing instructions, especially regarding:

– Data protection (Instruction 006/2020)

– Consumer consent protocols (Instruction 010/2020)

– Complaint handling mechanisms (Instruction 012/2020)

– Fee transparency (Instruction 011/2020)

B. For Data Providers (Banks, Microfinance, Payment Institutions) - Mandatory Participation: All institutions supervised by BEAC/COBAC must share credit information with approved BICs.

- Mandatory Consultation: Must consult a BIC solvency report before granting any new credit.

- Contractual Obligation:Must sign data-sharing agreements with CICA (Cameroon signing ceremony: February 2026, Yaoundé).

- Transmission Standards: Must comply with technical and procedural requirements under Instruction 014/2020.

C. For Consumers (Individuals & Businesses) - Consent Rights: Protected under Instruction 010/2020 – consent required before data sharing.

- Data Protection: Confidentiality guaranteed through multiple regulatory layers.

- Redress Mechanisms: Right to complain under formal procedures (Instruction 012/2020).

- Access Rights: To their own credit reports and correction of errors.

IV.

REGULATORY SUPERVISION & COMPLIANCE

A. Supervisory Architecture

- Primary Regulator: BEAC (Central Bank)

- Sectoral Regulator: COBAC (Banking Commission)

- Supervisory Framework: Based on Regulation 03/18 and implementing instructions

- Control Procedures: Detailed in Instruction 007/2020

B. Enforcement Mechanisms

- Financial Penalties: BEAC can impose sanctions per Instruction 013/2020.

- Approval Withdrawal:Possible for non-compliance, with database transfer to BEAC (Instruction 008/2020).

- Market Conduct Oversight: Continuous monitoring of BIC operations.

C. Cross-Border Considerations

The framework is CEMAC-wide, requiring:

- Harmonized application across all member states

- BIC expansion throughout the region (CICA’s obligation)

- Consistent enforcement by national authorities

V. STRATEGIC IMPLICATIONS FOR STAKEHOLDERS

A. For Financial Institutions - Immediate Action: Prepare systems for data sharing with CICA

- Compliance Deadline: Contract signing in February 2026 (Cameroon)

- Process Change: Integrate mandatory credit report checks into lending decisions

- Risk Management:Expect improved credit assessment capabilities

B. For Businesses (Especially SMEs) - Opportunity:Potential for better credit access and lower borrowing costs

- Responsibility:Maintain good credit history across all financial relationships

- Awareness: Understand rights regarding data consent and correction

C. For Legal Practitioners - New Specialization: BIC regulation and data protection law

- Advisory Role:Guide clients on compliance obligations

- Dispute Resolution:Potential growth in consumer credit disputes

D. For Regulators - Monitoring Focus: CICA’s 3-year performance against targets

- Market Development: Encourage additional BIC entrants (no monopoly intended)

- Framework Refinement: Adjust regulations based on operational experience

VI. IMPLEMENTATION TIMELINE & NEXT STEPS

- January 2026: CICA officially launched in Douala

- February 2026: Contract signing ceremony in Yaoundé for Cameroonian institutions

- Throughout 2026: BEAC/IFC finalize supervision cooperation framework

- By November 2028: CICA must demonstrate 60% market coverage across CEMAC

- Ongoing: Regulatory monitoring and potential approval of additional BICs

VII. CONCLUSION & RECOMMENDATIONS

The establishment of CICA under this comprehensive legal framework represents a significant advancement in CEMAC’s financial infrastructure. The success of this initiative depends on:

- Strict Enforcement of mandatory participation by data providers

- Conscientious Implementation by CICA of its performance obligations

- Robust Consumer Protection in practice, not just in regulation

- Gradual Market Opening to additional BICs as the system matures

Legal practitioners should: Familiarize themselves with the 14 implementing instructions, advise clients on compliance timelines, and monitor BEAC/COBAC communications for regulatory updates.

Financial institutions should: Immediately initiate technical and contractual preparations for data sharing with CICA, while updating internal credit policies to incorporate mandatory BIC report consultations.

This guide is based on publicly available regulatory texts and official announcements as of January 2026. Legal advice should be sought for specific compliance requirements.

Banyong Fonyam Jonie Jr.

Legal Consultant, Banking & Financial Regulation

Douala, Cameroon