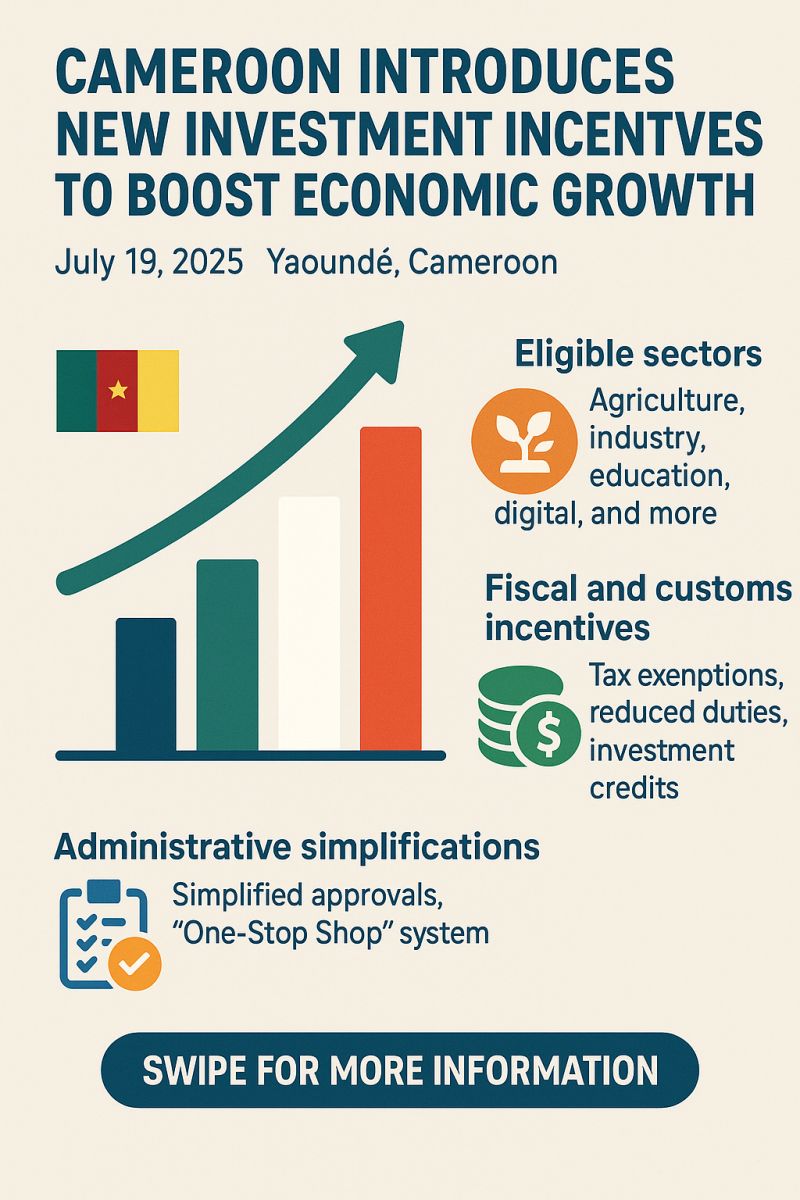

Cameroon Launches Bold Investment Incentives to Accelerate Economic Growth

On July 18, 2025, President Paul Biya signed Ordinance No. 2025/002 — a major step forward in Cameroon’s economic strategy. This new ordinance introduces a modern framework of fiscal, customs, and administrative incentives to stimulate investments across key sectors of the economy.

Here’s what you need to know:

Targeted Sectors

The incentives apply to strategic areas such as agriculture, livestock, fisheries, heavy industry, manufacturing, energy, education, health, transportation, tourism, and digital infrastructure.

Petroleum, mining, and commerce are excluded, as they follow separate regulatory frameworks.

Who Can Benefit?

The ordinance covers:

- New projects by startups or businesses entering new sectors

- Expansion projects aiming to increase capacity or diversify outputs

Two-Phase Incentive Framework

Phase 1: Installation (up to 5 years)

- Exemption from import duties on equipment and materials

- Waivers on VAT, property taxes, and real estate registration fees

Phase 2: Exploitation (up to 5 years)

- Reduced customs duties (as low as 5%)

- Tax credits from 25% to 80% based on investment scale and location

- Accelerated depreciation options

Extra Benefits in Priority Development Zones

Investments in special zones get even more support:

- Extended exploitation periods (up to 7 years)

- Full access to active processing regimes

- Exemptions from selected administrative charges

Support for Public-Private Partnerships

Aligned with Cameroon’s 2023 PPP Law, the ordinance offers tailored benefits for public-private collaborations, including government-covered import duties and tax deductions throughout all phases.

Faster Approvals Through a One-Stop Shop

Investors will now benefit from streamlined administrative procedures — including faster access to permits, visas, and customs clearance — through a central one-stop platform.

Monitoring and Chttps://banyongfonyamjoniejr.com/anti-bribery-and-corruption-abc-compliance-framework/ompliance

A new Audit and Appeals Committee will oversee compliance, with penalties in place for projects that fail to meet commitments.

What’s the Goal?

- More jobs and skills for Cameroonians

- Greater use of local materials and value-added production

- Increased exports of locally made products

- More transparent, accountable investment processes

What About Existing Investors?

Businesses already under previous regimes can transition to this new framework, as long as they meet updated eligibility requirements without overlapping benefits.

Final Thoughts

This ordinance reflects Cameroon’s commitment to becoming a top investment destination in Central Africa. With a clear roadmap and investor-friendly environment, the country is laying the foundation for long-term, inclusive economic growth.

For more details, consult the full Ordinance No. 2025/002 or contact the Cameroon Investment Promotion Agency.

CONTACT US @ info@banyongfonyamjoniejr.com

[…] 33%Exemption from business licensing feesTax incentives for employeesResearch and development allowancesIt is essential to understand that these benefits are not granted automatically. Startups must meet […]