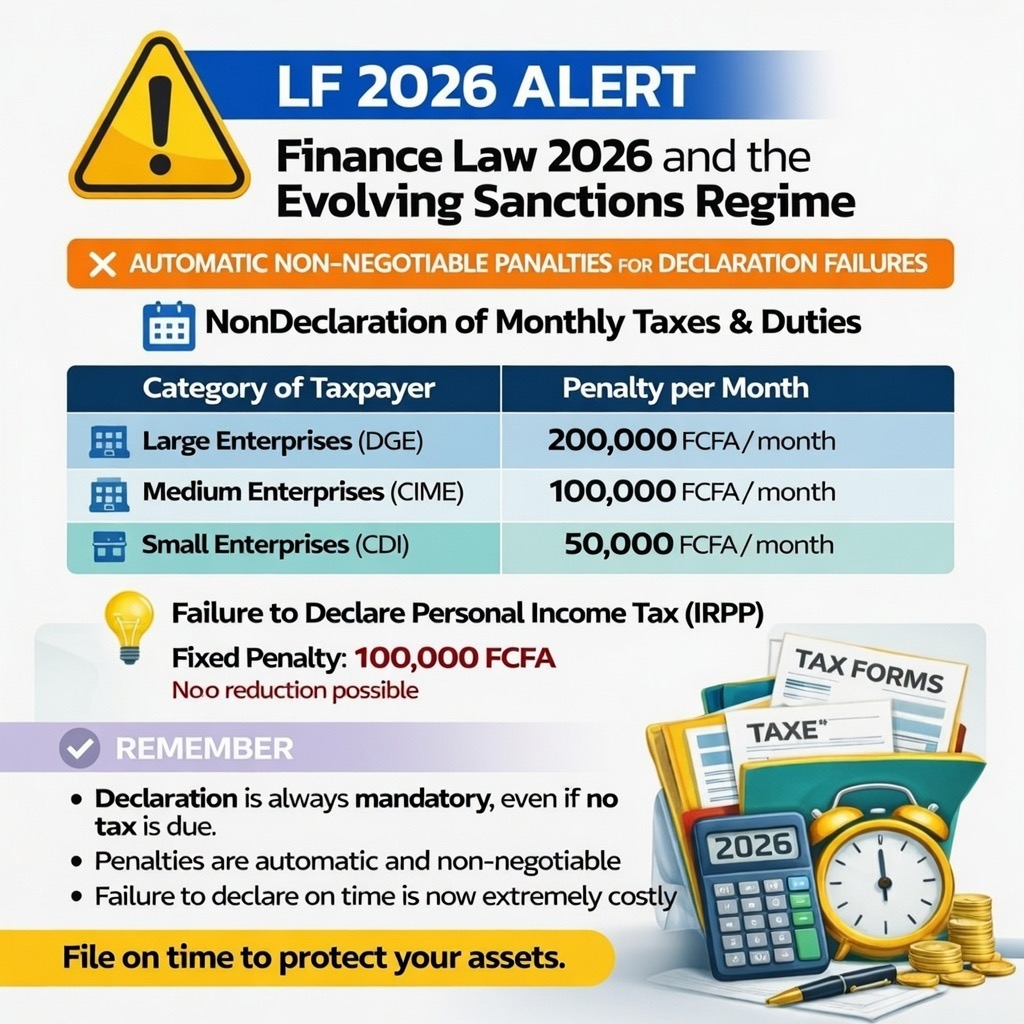

Finance Law 2026 and the Evolving Sanctions Regime.

INTRODUCTION: A New Era of Fiscal Rigor is Here

The promulgation of the Finance Law for 2026 (LF 2026) marks a decisive shift in Cameroon’s fiscal enforcement landscape. The General Directorate of Taxes (DGI) has been equipped with a powerful, automated arsenal of sanctions designed to penalize non-compliance without exception. As a seasoned corporate legal, compliance, and tax professional with over 15 years of experience navigating the complexities of OHADA law and Cameroon’s fiscal code, I, Banyong Fonyam Jonie Jr., deem it a critical professional duty to dissect these provisions for you. At Fonyam & Partners, we have built our reputation on proactive compliance strategy and robust taxpayer advocacy. This article is a clarion call to action: the era of negotiable penalties is over; the era of meticulous compliance must begin.

DECODING THE AUTOMATIC SANCTIONS: A Compliance Minefield

LF 2026 introduces a regime of automatic, non-negotiable fines for declaration defaults. The key terms are “automatiques” and “sans remise” – meaning no warning, no grace period, and no possibility of a reduction or waiver upon application.

1. Monthly Declaration of Taxes and Duties: A Costly Omission

The law establishes a sliding scale of monthly penalties for failure to submit mandatory monthly declarations (e.g., VAT, Withholding Taxes, CNS), even if the tax liability for the period is zero.

Category of Taxpayer Penalty per Month of Default

Large Enterprises (DGE) 200,000 FCFA

Medium Enterprises (CIME) 100,000 FCFA

Small Enterprises (CDI) 50,000 FCFA

Legal Implication: This is a pure administrative penalty, applied automatically by the tax system. For a large enterprise, a mere 6-month oversight on a nil declaration could result in a 1.2 million FCFA penalty, purely for procedural non-compliance.

2. Default in Declaring Personal Income Tax (IRPP)

A substantial fixed penalty of 100,000 FCFA is now attached to the failure to file an annual IRPP declaration. Crucially, this applies regardless of whether the individual ultimately had any taxable income.

CORE LEGAL PRINCIPLES ESTABLISHED BY LF 2026

1. The Obligation to Declare is Absolute: The act of declaration is separate from the act of payment. Compliance is first and foremost about fulfilling this declarative obligation by the statutory deadlines.

2. Zero Liability Does Not Mean Zero Obligation: Taxpayers must disabuse themselves of the notion that “no tax due” equals “nothing to file.” This misconception is now extraordinarily costly.

3. Erosion of Administrative Discretion: The “sans remise” clause significantly reduces the tax administration’s traditional discretion to grant leniency. Appeals will now focus almost solely on proving the declaration was actually filed, not on pleading for mercy.

PROFESSIONAL RECOMMENDATIONS FROM FONYAM & PARTNERS

To shield your business and personal assets from these automated penalties, we advise the following immediate actions:

1. Calendar & System Audit: Review and reinforce your internal calendar for all tax deadlines (monthly, quarterly, annual). Implement double-check protocols.

2. Documentary Proof: Ensure you have irrefutable proof (acknowledgement of receipt, certified electronic submission logs) for every declaration made. In a dispute, the burden of proof shifts to the taxpayer.

3. Seek Proactive Counsel: Engage with compliance professionals before deadlines, not after penalties are levied. Our firm offers Compliance Health Checks to identify vulnerabilities in your declarative processes.

4. Training: Ensure your accounting and finance staff are fully briefed on these new, non-negotiable consequences.

WHY THIS MATTERS: A Message from the Managing Partner

“In my practice, I have witnessed the severe financial and reputational damage that arises from treating tax compliance as an afterthought. The LF 2026 is the legislature’s strongest signal yet that such an approach will no longer be tolerated. At Fonyam & Partners, we believe that intelligent compliance is not a cost, but a cornerstone of sustainable business strategy and corporate citizenship. We stand ready to guide our clients through this new, stricter fiscal environment with strategic planning, rigorous representation, and a deep understanding of the letter and intent of the law.”

About Us:

Fonyam & Partners is a premier Cameroonian law firm specializing in corporate law, tax advisory, litigation, and compliance. Led by Banyong Fonyam Jonie Jr., a professional renowned for his expertise in cross-border taxation and regulatory compliance, our firm is dedicated to providing cutting-edge legal solutions that protect our clients’ interests and foster their growth within the bounds of the law.

Disclaimer: This article is for informational purposes only and does not constitute legal advice. For tailored advice regarding your specific circumstances, please consult directly with a qualified legal or tax professional.

Contact Fonyam & Partners for a confidential consultation on your compliance posture under LF 2026.

Declarer à temps, c’est protéger votre patrimoine.

(To declare on time is to protect your assets.)

Fonyam & Partners – Your Partner in Compliance and Growth.